TSPMarketTiming.com

The simplest and most straight-forward approach for maximizing your retirement savings.

Read More »

TSPMarketTiming.com is not affiliated with the TSP, Thrift Savings Plan, tsp.gov, frtib.gov, or any U.S. government agency or uniformed military services.

Our Trading Model

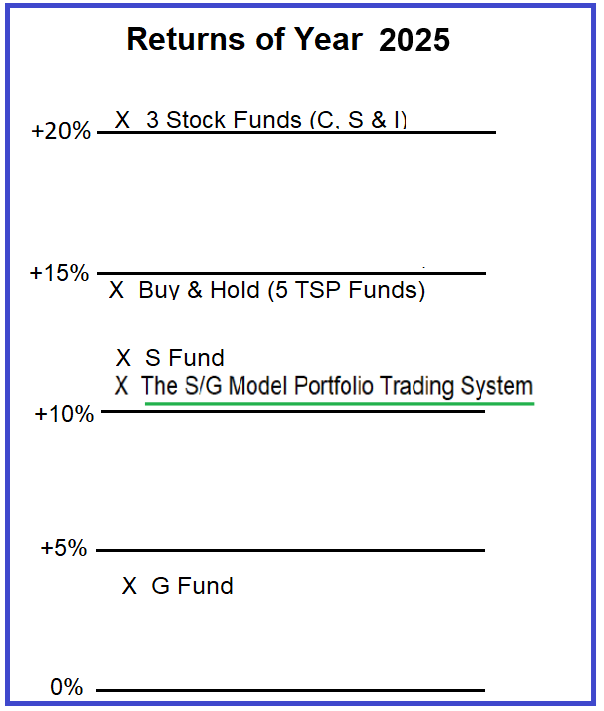

TSPMarketTiming was founded on the idea that successful growth of retirement savings could be quantified with a math-based approach, not opinions.

Read More »

Effectively Build Your Savings

Our mission is to help you maximize your savings, even through a market crash.

Read More »

Low-Risk / High-Reward

We strongly believe we have designed the Ultimate Trading Model™, and most of all, meets Federal Government Policies.

Read More »

We Welcome Your Membership

We are passionate about helping people obtain the income you will need for a wonderful retirement.

Join Now »